The Fed Plants A Flag On Peak Inflation and An Economic Soft Landing

Posted: December 3, 2022 Filed under: Bond market, Economy, Jobs, Monetary Policy | Tags: federal funds rate, Federal Reserve, inverted yield curve, Monetary Policy, proxy funds rate, recession, S&P 500, SPY 7 CommentsRobert G. Valletta, associate director of research and senior VP at the SF Fed, planted a flag on peak inflation and an economic soft landing in a recent economic research blog post. Valetta provided data suggesting that inflation is finally on a sustained path lower alongside increased risks for a mild recession. The blog post is not an official statement from the Federal Reserve Board of Governors, but the work is a powerful message nonetheless.

Valetta declared “recent data suggest that inflation may have peaked.” The latest inflation projection shows a gradual decline toward the Fed’s 2% average goal around 2025 or 2026. Valetta cautions that “repeated upside surprises” to inflation mean that “the risks to this forecast [are] weighted to the upside.” In other words, we should expect the Federal Reserve to keep its interest rate higher for longer in order to ensure inflation’s glide path stays pointed downward. The graph below shows the recent peak and successive higher forecasts for inflation since March.

After on-going upside revisions, PCE core price inflation is now expected to approach the 2% target somewhere around 2025. (Source: Federal Reserve Bank of San Francisco)

The cost of peaking inflation is slower growth. Valetta expects “growth to remain well below trend this year and next year before converging back to trend in 2025.” Conveniently, that return to trend occurs just as inflation returns to the Fed’s target. Most importantly, Valetta points to a mere one percentage point increase in unemployment “through 2024.” This expectation means that the onset of a recession next year will create a mild economic slowdown. Today’s unemployment rate is still near the historic low of 3.5%. Unemployment below 5% is surprisingly low for a recessionary environment. The high job vacancy rate softens the economic blow of slowing growth as there is plenty of room to cool off labor demand without disrupting the labor market.

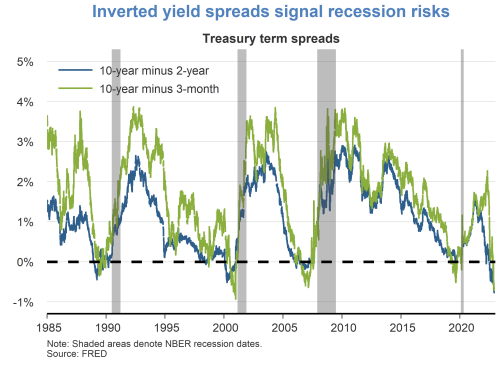

Valetta acknowledged that the inversion of the yield curve suggests that odds are high for a recession: “such yield curve inversions have proven historically to be reliable predictors of recessions over the subsequent 12 months. After some divergence earlier this year, two leading measures of the yield spread have now both become inverted.” However, Valetta does not want readers to decide that a recession is a foregone conclusion: “their predictions come with substantial statistical uncertainty, however, and are not definitive indications that a recession is looming.”

Inverted yield curves have preceded recessions since the late 1980s. (Source: Federal Reserve Bank of San Francisco)

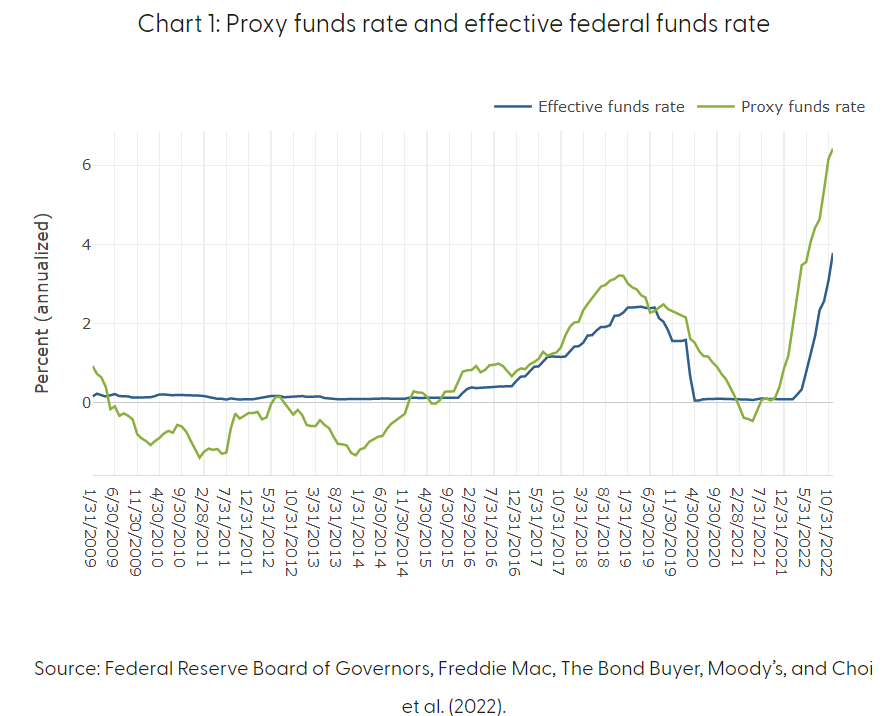

The Fed’s success in fighting inflation has come from a “proxy funds rate” that is much higher than the effective funds rate. According to the SF Fed, “this measure uses public and private borrowing rates and spreads to infer the broader stance of monetary policy.” The gap between the proxy and effective rate is higher than ever. No wonder Fed Chair Jerome Powell can so comfortably reiterate that the Fed can now slow the pace of rate hikes.

With peak inflation finally here, traders and investors should focus on how long the Fed intends to keep a restrictive stance on monetary policy. Given the extended period over which the Fed expects above target inflation, monetary policy should remain restrictive for longer than the market currently expects. In turn, the implication for the stock market of restrictive policy and below trend growth means valuations must come down further and cap upside in market returns for 2023 and perhaps 2024. Time will tell of course.

The S&P 500 (SPY) is out of bear market territory and now trying to fight its way through restrictive monetary policy.

Be careful out there!

[…] basis points year-over year to 20%. This inflation resilience may not be as important going forward if inflation has indeed peaked, but at least the pricing power demonstrates the stickiness of the water products and […]

[…] that U.S. inflation has apparently peaked, odds favor month-over-month declines in the CPI (consumer price index). The November CPI numbers […]

[…] that U.S. inflation has apparently peaked, odds favor month-over-month declines in the CPI (consumer price index). The November CPI numbers […]

[…] The Fed Plants A Flag On Peak Inflation and An Economic Soft Landing → […]

[…] is pretty well excepted that inflation peaked several months ago. However, when Blinder worries that “no one will notice” the drop in inflation, he is […]

[…] market bottomed in October when market participants concluded that inflation had finally peaked. Inflation’s peak does not equal the Fed’s inflation target; the Fed has gone to great lengths to issue these […]

[…] mortgage rate rushed so much to price in Fed rate hikes that it peaked in November, one month after core inflation itself peaked. Subsequent rate hikes have only applied marginal upward pressure to mortgage rates. As a result, […]