Farm Acreage Continues to Increase with Crop Prices

Posted: December 31, 2011 Filed under: Agriculture | Tags: farmland Leave a commentThe NY Times describes how the increasing prices of crops has allowed farmers to increase farm acreage into previously unthinkable plots. Marginal land is now productive land with the high prices available for crops.

“Across much of the Midwest the sharp increase in farm earnings has driven the price of farmland to previously unimaginable — and, some say, unsustainable — levels. But in the process, to much less fanfare, the financial rewards have also encouraged farmers to put ever more land into production, including parcels that until recently were too small or too poor in quality to warrant a second glance…

…farmers, flush from the most profitable years in decades and looking for better places to store money than low-interest savings accounts or a turbulent stock market, are putting their money in land.”

According to an Iowa State study, farmland in Iowa increased 32% last year to $6,700 per acre.

See “As Crop Prices Soar, Iowa Farms Add Acreage” for more details.

Agflation finally slowing down

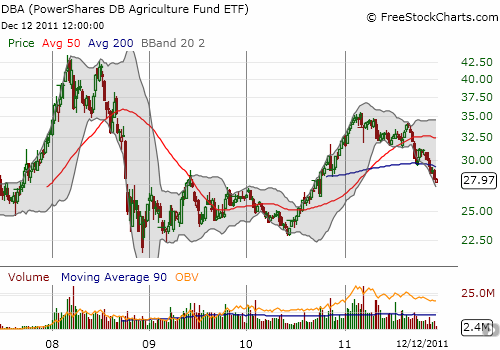

Posted: December 13, 2011 Filed under: Agriculture, food | Tags: DBA, food, PowerShares DB Agriculturae Fund ETF 1 CommentGlobal supplies of agricultural products are expanding, perhaps in response to past shortages. These forces are driving down prices and discouraging hedge funds from making bullish bets in agricultural commodities. According to Bloomberg in “Funds Reduce Bets on Rising Food Costs to Lowest in 27 Months: Commodities“, the bullishness of hedge funds has reached lows not seen in over two years.

Here is a key quote that describes the situation:

“World food prices tracked by the United Nations retreated for a fifth consecutive month in November, the longest decline in more than two years. The U.S. government said Dec. 9 that combined global inventories of corn, soybeans and wheat will be 3.2 percent larger than anticipated a month earlier. Cocoa capped its longest slump in 50 years last week on increasing supplies from Ivory Coast, the world’s biggest producer.”

DBA, the PowerShares DB Agriculturae Fund ETF, tells the story. the ETF has now sunk to 14-month lows. Today’s price marks the previous post-recovery high in 2009.

After going straight up for nine months starting in 2010, DBA has now gone nearly straight down since its April highs

FedEx Increasing Ground Rates, Reducing Fuel Surcharge

Posted: December 6, 2011 Filed under: Shipping | Tags: FDX, Federal Express Leave a commentFederal Express (FDX) announced that it will raise rates for ground shipping by 5.9%. Fuel surcharges are getting cut by 1%. For more details see: “FedEx Ground to Raise Rates 4.9 Percent”

Note that this compares to a UPS rate hike of 4.9% for ground shipping, and recent moves by the U.S. Postal Service to hike shipping rates to stave off bankruptcy.